From AI hype to real systems: what’s changing in tech, what to watch, and what founders should do next

In our first Leadership Talks Q&A, we sat down with Franco Monsalvo, Revolt’s CTO and Co-founder, to talk about how the tech market has shifted in the last few years—especially under the shadow of AI.

We covered the “post-hype” phase of generative AI, why infrastructure is becoming the real battleground, what signals Franco watches to understand the market, what’s actually happening in the U.S. right now, and why the future belongs to people who can think and model systems, not just produce code.

Q: How do you see the tech market today vs. 1–3 years ago?

Franco: The market is very different, and not only because of technology. You have to factor in context: COVID, the investment cycle, layoffs, and a broader “wait and see” attitude that shaped decision-making for a while.

After COVID and the pullback in funding, many people expected 2024–2025 to bring a clean recovery. But AI created a different dynamic. Instead of accelerating investment, it made a lot of companies pause.

They were thinking: “If AI is about to change all of my processes and potentially my business model, does it make sense to keep investing in technology the same way?” That uncertainty created a kind of fog across many organizations.

What feels different now is that we’re moving into a more realistic phase. We’re past the constant daily headlines of “AI will replace everything,” and we’re closer to the moment where people ask: Where does AI actually make sense? Where doesn’t it? And that’s healthier.

There’s also something else happening: we’re reaching a plateau in the “exponential improvement” narrative for the biggest models. That doesn’t mean nothing new is happening—it means the pace is stabilizing in key areas, and companies are becoming more focused on building real things on top of these models rather than obsessing over the models themselves.

In a way, the base models are becoming closer to a commodity. And once something becomes a commodity, it enables the most interesting layer: applications.

Takeaway: We’re shifting from “models as the product” to “models as infrastructure”—and the value moves to what you build with them.

Q: Does that plateau mean there’s an AI bubble that could burst?

Franco: I don’t think there’s a bubble in the “applications” sense. There’s real value being created. AI is genuinely changing workflows and improving outcomes in a lot of places. But there is a financial sustainability question that’s different.

When you look at the cost of scaling, more compute, more energy, bigger data centers, the idea of infinite growth becomes unrealistic. The problem isn’t “AI is fake.” The problem is: How do you keep scaling the current approach in a sustainable way?

A lot of the AGI narrative also needs to be separated from what’s actually happening. LLMs are powerful, but they’re not a magic path to general intelligence. The real question is what direction the next evolution takes—does the industry find a sustainable way to keep improving, or does it shift to a different paradigm?

And on the business side, you’re seeing signals that companies are under pressure to monetize. That doesn’t mean the technology goes away. It means the market needs to mature into sustainable economics.

Also: if a major player collapses, the world won’t stop. Another major platform could become the reference point. The technology continues.

Takeaway: The “bubble” risk is less about the usefulness of AI and more about the economics of scaling and monetization.

Q: When you’re trying to read the market, what signals do you pay attention to?

Franco: I look at a mix of signals, because the market is influenced by technology and finance at the same time.

On the financial side, you watch things like the state of funding and IPO activity, valuations and how they’re changing, monetization moves that feel unusual or forced (those are signals too), the appetite for long-term, high-risk infrastructure bets (like massive data centers).

On the technology side, you watch whether progress still looks exponential or starts flattening, what the industry is shifting focus toward (models vs. tooling vs. platforms), where real adoption is happening, what problems people are solving in production.

The challenge is that signals are mixed. You can misread them. That’s why many companies stay cautious, they’re making big investments under uncertainty, and AI changes the prediction problem.

One thing I do think is healthy: hype signals have gone down. That creates room to focus on what’s real.

Q: Is the market behaving the same everywhere, or is it different by region?

Franco: There are always maturity differences.

Typically, the order is: U.S. first, then Europe, and LatAm tends to be more of a consumer than a creator in terms of shaping global maturity. This time, it was interesting because China/Asia moved faster than Europe in adoption and maturity in some areas.

So yes—global trends exist, but the speed and depth vary.

Q: You were recently in the U.S. Did you notice anything different in conversations there?

Franco: One positive thing: not everyone was talking about AI.

That sounds small, but it’s meaningful. It suggests a return to normal business thinking: building, growing, delivering, managing real constraints.

The events I attended were also very practical. Less theory, less hype—more “we hit this infrastructure problem, here’s how we solved it,” “here’s how we scaled,” “here’s what broke in production.”

That’s a sign of maturity: when people stop talking about the idea and start talking about what failed, what worked, and why.

Takeaway: The “AI-only” conversation is fading. Practical execution is back.

Q: What are companies actually doing with AI right now?

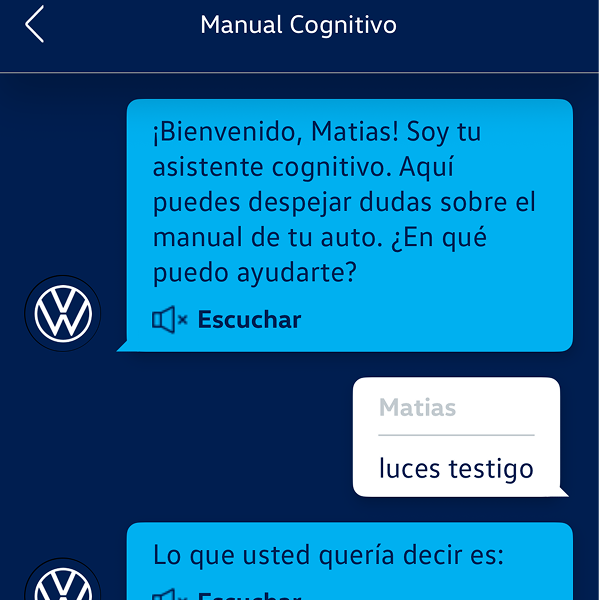

Franco: The obvious ones are still there: customer support, chat interfaces. That wave already happened.

What I see more of now is:

-

AI for analysis and context (helping teams work with information faster)

-

AI inside workflows that can be automated or augmented

-

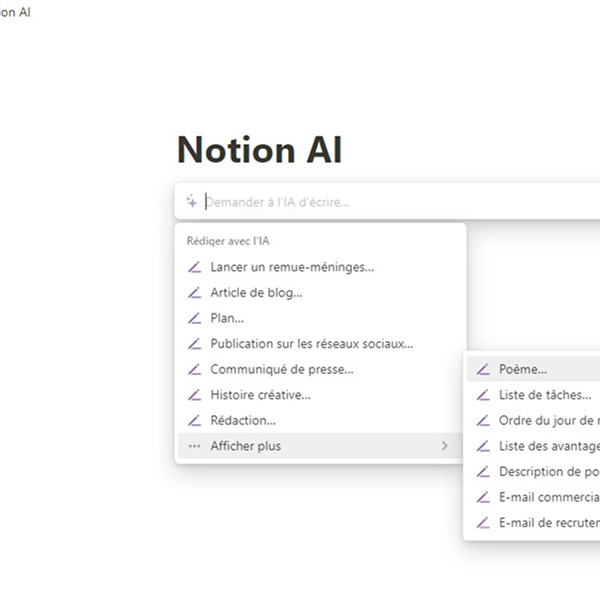

Assistants (educational, internal, personal—tools that help people operate)

-

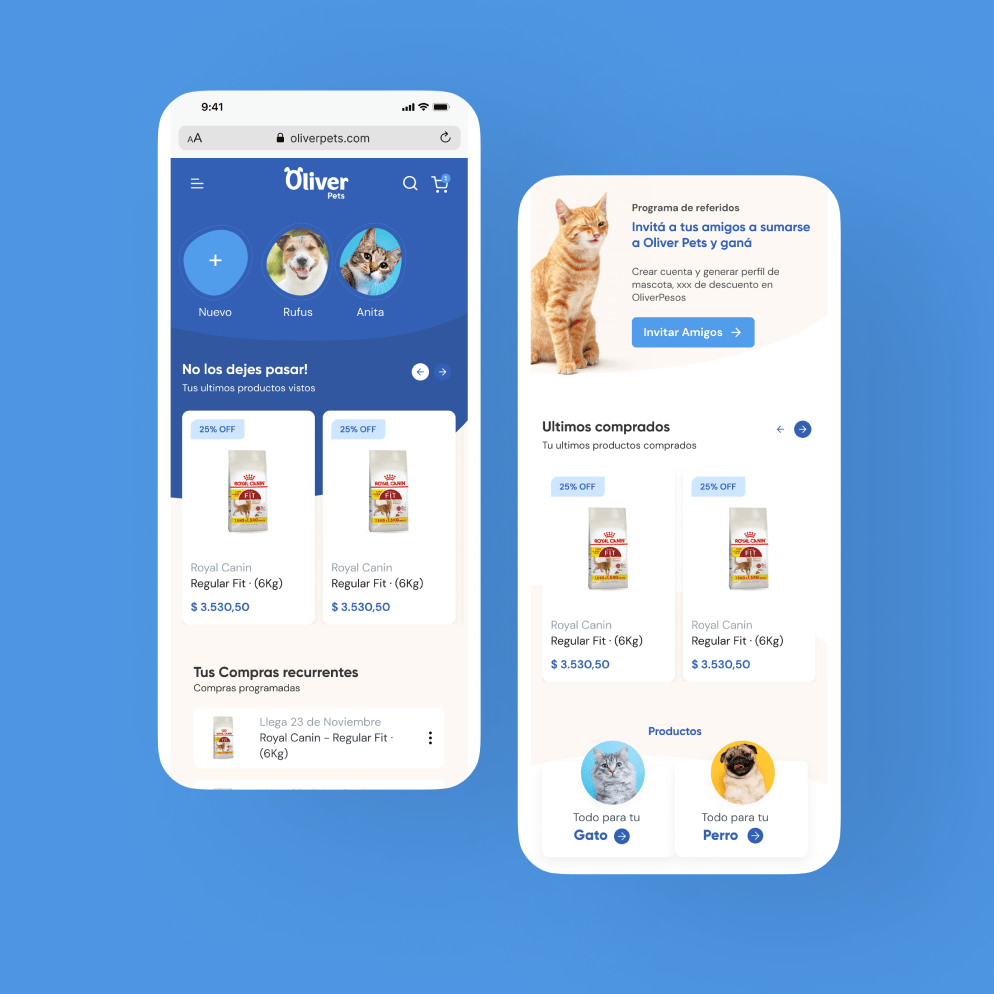

AI as a “third-party service” inside a product, not the product itself

There’s also a lot happening in healthcare: using AI to analyze data for earlier detection, operational efficiency, or better decision support—though that comes with constraints (privacy, regulatory requirements).

And increasingly, people are thinking about the integration layer: how AI interacts with products through APIs/SDKs, how it fits into a platform as just another component.

Q: What’s not being explored enough?

Franco: Two areas I personally don’t see as much momentum in (though it could be happening outside my bubble):

-

Computer vision / vision models: the tools are significantly better than before, and there are real “old hard problems” that are now much more solvable.

-

IoT + robotics: there’s huge potential, but much of the mainstream attention shifted to LLMs, and many other AI domains got deprioritized.

Before LLMs, AI meant a broad set of capabilities—machine learning, vision, inference, optimization. LLMs became the center of gravity, and a lot of the ecosystem started treating everything like a text problem.

That’s not always the right fit.

Q: What’s your view on the future of work for builders?

Franco: Absolutist statements like “developers are done” are not serious.

What I do believe is this: a portion of the market that focused mostly on writing code—without strong systems thinking—will struggle.

A software developer isn’t someone who types code quickly. The real job is:

-

Thinking

-

Modeling

-

Designing solutions

-

Understanding trade-offs

-

Building systems that scale and last

AI can reduce the cost of writing code. That means “coding-only” skills become less defensible. But if you understand architecture, systems, and product constraints, AI becomes leverage—not replacement.

The short-term outcome isn’t “no developers.” It’s that unskilled supply gets pressured, and the demand for people who can design real systems remains.

Takeaway: AI doesn’t remove the need for builders—it raises the bar on what “builder” means.

Q: What keeps you excited about Revolt?

Franco: The opportunity is still there. We can still build products that matter, that help businesses grow, and that make sense.

Tools change. Context changes. But what we do is not “build software the traditional way.” We focus on building businesses—using technology as a vehicle.

And that stays interesting.

Q: One thing you changed your mind about in the last year?

Franco: I was more skeptical early on about AI. I thought it might remain mostly hype, or that the impact would be smaller.

It turned out to be more useful and more powerful than I expected. Even if progress slows from here, the AI platform itself is valuable. That was a big shift for me.

Q: One piece of advice for founders right now?

Franco: Don’t get trapped by hype—and don’t become a hype generator.

Stay rational. Keep a clear north star.

Take risks, but be conservative with spending. Keep a buffer. The market is volatile, and you need resilience.

And choose co-founders wisely: complementary skills and people you genuinely want to spend time with. It’s a long road, and having the right core team matters more than people admit.