A Turning Point for AI in Finance

AI in Finance 2025 left one thing very clear: artificial intelligence is no longer a distant innovation or a promising buzzword—it’s a business enabler already transforming how the financial sector operates, competes, and delivers value. Held at the Sheraton Convention Center in Buenos Aires, AIFI25 brought together banks, fintechs, insurers, and payment companies to discuss where the industry is heading—and how to get there.

From Vision to Value: How the Conversation Is Shifting

One of the main takeaways was that the conversation around AI in finance is maturing. No longer confined to theoretical panels or futurist demos, the discussion is now anchored in real business outcomes. Speakers from Pomelo, Banco Galicia, Mercado Libre, and N5 emphasized a critical point: AI isn’t about cutting costs—it’s about gaining speed, clarity, and scalability. In many cases, implementing AI tools can actually be more expensive than traditional staffing, but the trade-off is in measurable productivity gains and better customer outcomes.

Three Layers of AI Adoption

The agenda explored three core perspectives for understanding AI’s role in the industry. First, the defensive layer: tools like chatbots and AI-assisted internal platforms that bring immediate gains in productivity and operational efficiency. Second, the expansive layer: strategic implementations in fraud detection, onboarding, customer scoring, and hyper-personalized UX. These generate mid-term ROI by improving performance metrics. And third, the disruptive layer: innovations that reframe the very structure of financial products and services, such as multi-agent ecosystems, autonomous transactions, or conversational commerce.

Why Execution Matters More Than Technology

One session in particular, led by Nación Servicios, proposed a critical framework: successful implementation depends less on the AI models themselves, and more on how data is organized, use cases are scoped, and the organization is prepared to run pilots and iterate in production. The journey from PoC to full-scale production is not linear, and decision makers need to understand where friction exists—technical, organizational, or cultural.

The Fintech-Banking Convergence

The tension between agility and control also came up repeatedly. Banks are under pressure to accelerate digital innovation, but legacy systems and compliance environments often slow them down. Fintechs, on the other hand, have the agility but lack the scale. AIFI25 suggested that convergence between the two is inevitable. In fact, some of the most forward-thinking institutions are already building hybrid models: regulated banks with embedded fintech capabilities, and fintechs with banking-grade infrastructure.

Data: The Real Competitive Advantage

Trust remains the currency of the sector. From scoring systems to fraud detection, tokenization, and onboarding, AI is increasingly playing a central role in maintaining the integrity of financial systems. But as several speakers pointed out, the quality of AI outcomes is only as strong as the data feeding them. Clean, structured, and secure data is still the single most valuable asset for AI success.

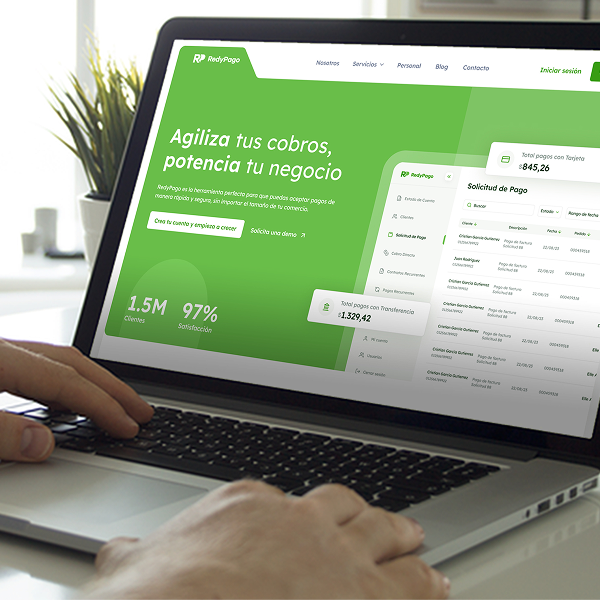

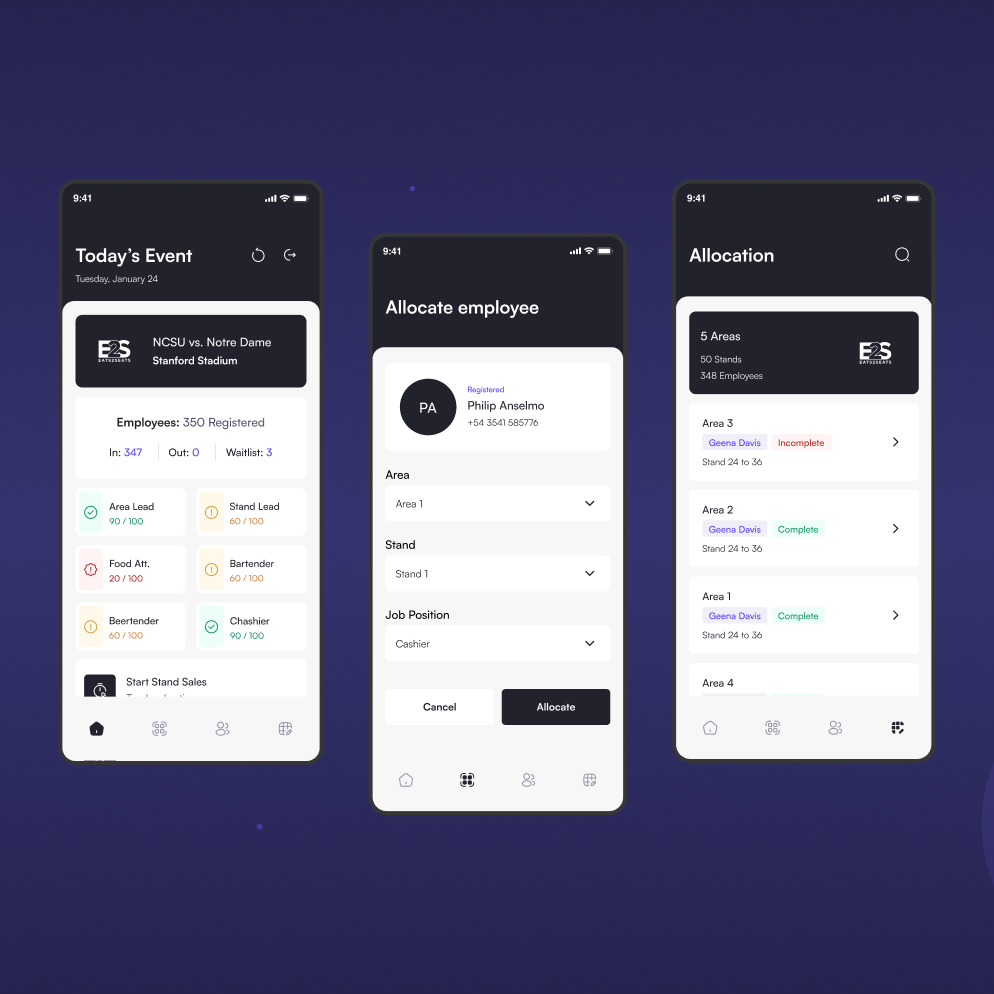

Revolt’s Perspective: Design Meets Data in Fintech

At Revolt, we believe that great digital products in finance are built at the intersection of design, technology, and data clarity. AIFI25 reaffirmed this view: the future of finance is not about replacing humans with machines, but about amplifying expertise, reducing friction, and delivering faster, safer, and smarter services to users.

This is not the AI of tomorrow. It’s the AI of now—and it’s already shaping the future of finance in Latin America.