This is not a “Top 10 AI trends” list.

It’s a point of view on how behavior, infrastructure and incentives are about to shift in 2026 — and what companies need to do about it.

We focus on three areas where we see real change:

-

Commerce: when agents start buying for us.

-

Fintech: where AI quietly rewires risk, advice and money movement.

-

Digital Products: from features to intelligent systems.

You’ll find:

-

Narrative sections you can share with leadership teams.

-

Bulleted “So what?” blocks for operators.

-

Suggested visuals to turn this into a fully designed asset.

1. Executive Summary

2026 won’t be defined by “AI everywhere.” It will be defined by how well organizations are prepared for AI to act on their behalf.

Three big shifts stand out:

-

Commerce:

Buying journeys will increasingly start and end with agents, not humans. Brands that fail to expose clean, structured, machine-readable product data will quietly disappear from the “consideration set” of AI assistants. At the same time, AI-generated advertising will flood the market, commoditizing average creative and amplifying the value of truly original work.

-

Fintech:

AI will become a default financial advisor layer, embedded into apps people already use. Quietly, fraud detection will become one of the most critical AI use cases, even if it never trends on social media. Crypto may not have a single “revolutionary moment”, but stablecoins and borderless transfers will push toward mainstream utility. -

Digital Products & Systems:

The winners will not be those with the most AI features, but those with clean systems, disciplined data, interoperable architectures and products that can cooperate with both humans and agents. Product teams will evolve into hybrid intelligence teams, blending product thinking, systems design, AI literacy and operational rigor.

For decision-makers, this translates into four priorities:

-

Make your data and products legible to machines, not just humans.

-

Treat fraud, risk and trust as strategic, not operational.

-

Design products as intelligent systems, not feature collections.

-

Invest in the “invisible work”: taxonomy, governance, process clarity, orchestration.

2. The 2026 Context: AI Moves Under the Surface

For the last few years, AI has been sold through demos and interfaces: chatbots, copilots, generative tools. In 2026, the most important changes will be less visible.

Agents will compare products before we ever open a browser.

Ad infrastructure will produce thousands of ads before a human writes a single line.

Financial engines will assess risk and detect fraud in milliseconds, silently.

Products will decide which workflows to trigger, which data to surface, which options to hide.

The key pattern:

AI amplifies whatever foundation you already have — clarity or chaos.

This is the lens we use throughout this whitepaper.

3. Commerce in 2026: When Agents Become the Buyers

3.1. Agentic Commerce: Your New Customer Is Not (Only) Human

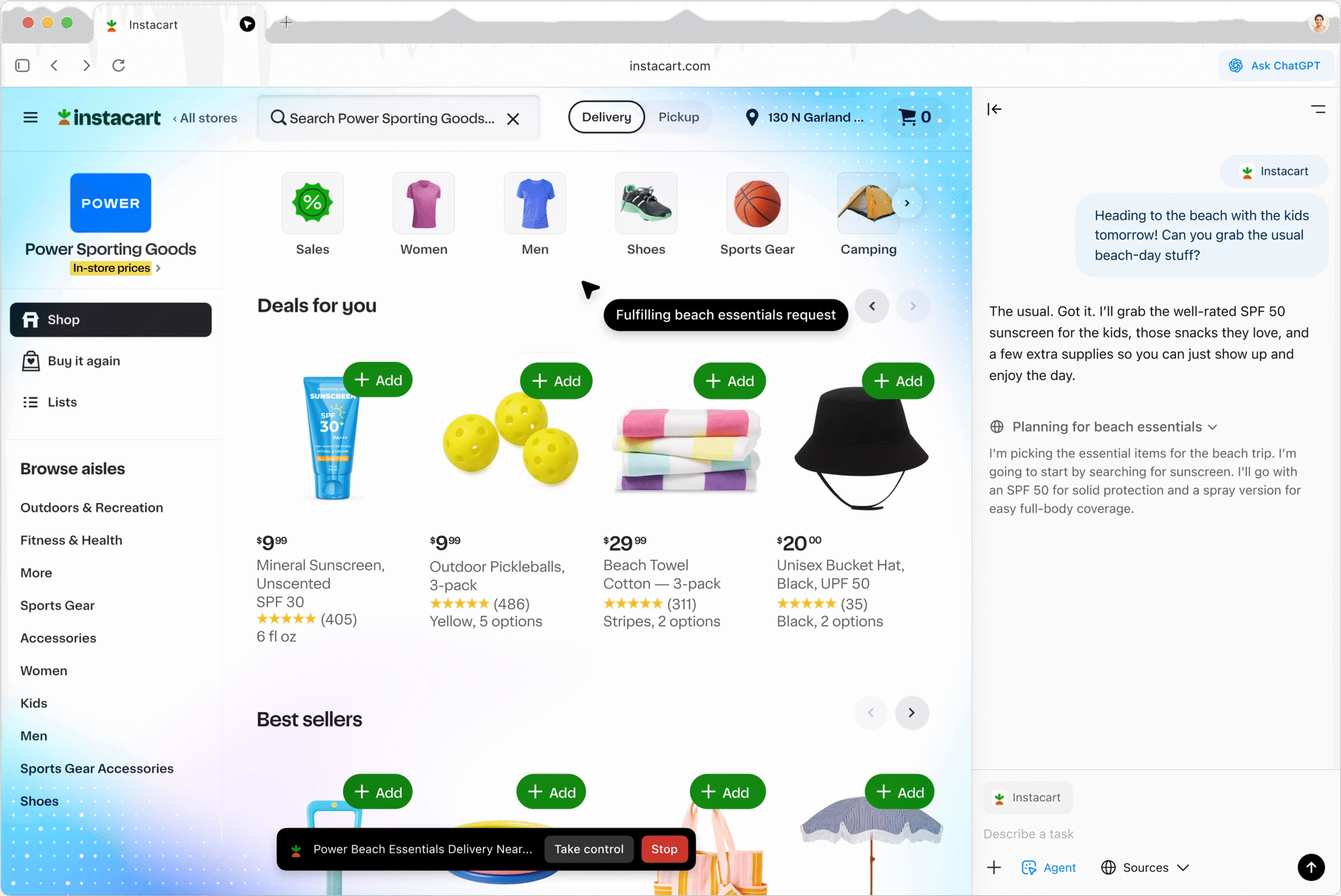

We are entering the first real phase of agentic commerce: AI assistants that can search, compare, decide and purchase on behalf of people.

A shopper might simply say:

“Find me the best pair of running shoes under $150 that work for pronation, deliver in under 48 hours, and have a good return policy.”

That’s not a search query.

It’s a delegated task.

The agent will then:

-

Query multiple sources.

-

Compare specs, prices, delivery times and reviews.

-

Filter by constraints: pronation support, budget, timeframe, brand bias.

-

Suggest 1–3 options — and in many cases, complete the purchase.

In this world, brands no longer compete only for human attention.

They compete for agent trust and compatibility.

What changes for brands

To be visible and purchasable in agentic commerce, brands will need to:

-

Maintain machine-readable product catalogs with clear, consistent attributes.

-

Keep stock, pricing and shipping data up to date in real time.

-

Offer transparent policies (returns, warranties, support) that agents can parse.

-

Build APIs and data feeds that agents can reliably consume.

If your product data is ambiguous, inconsistent or incomplete, agents will skip you — not out of malice, but out of design.

💡 Key idea:

“AEO” (Agent Engine Optimization) becomes as important as SEO.

3.2. Marketing in an Agent-Mediated World

Agentic commerce doesn’t kill storytelling, but it changes where it matters.

-

Above the agent line, brands still communicate with people: narrative, values, emotion, community.

-

Below the agent line, brands must become radically clear, structured and credible for AI systems: specs, reliability, trust scores, fulfillment performance.

The brand that wins is the one that is:

-

Emotionally resonant for humans, and

-

Perfectly legible to agents.

This implies closer collaboration between marketing, product, data and engineering than most organizations have today.

3.3. AI-Generated Advertising: Flooding the Zone

Another big force in 2026: a massive wave of AI-generated advertising.

It will be easier than ever to generate:

-

Hundreds of ad variations.

-

Countless images and videos.

-

Auto-optimized copy for every segment and channel.

The result will not be a creative renaissance.

It will be commoditization.

Most ads will start to look and feel the same:

similar aesthetics, similar language, similar emotional arcs.

That’s not a bug of the tools; it’s a property of models trained on the same patterns and optimized for the same performance metrics.

The paradox: creativity matters more than ever

When the baseline creative is cheap and abundant:

-

95% of the output becomes noise.

-

5% becomes structurally more valuable.

The agencies and brands that stand out will:

-

Use AI as a provocation tool, not a production crutch.

-

Lean into weirdness, tension, and non-obvious concepting.

-

Take reputational and aesthetic risks others are too optimized to take.

💬 Revolt’s stance:

The more AI fills the world with average creative, the more room there is for brave work.

3.4. What Commerce Leaders Should Do Now

Questions to ask in 2026 planning:

-

Can an AI agent understand our catalog without human help?

-

If we hid our website UI and left only our data layer, would a machine still know what we sell, to whom, and at what standards?

-

Are we prepared for media costs to stay high while creative quality collapses?

Practical moves:

-

Clean and standardize your product data model.

-

Invest in APIs and feeds optimized for third-party agents.

-

Push your creative partners beyond “AI-assisted production” into genuinely new territory.

4. Fintech in 2026: Quiet Transformations

Fintech won’t have its loudest year in 2026. But it will have one of its most consequential.

4.1. AI as a Financial Advisor Layer

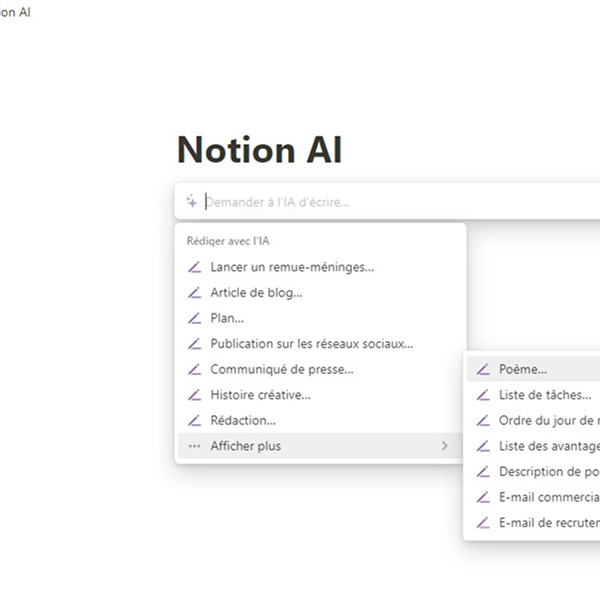

The idea of AI as a “financial advisor” is no longer speculative. We’re already seeing products that:

-

Help people understand their spending behavior.

-

Project future scenarios based on income, savings and debt.

-

Suggest how to allocate cash between saving, investing and paying down liabilities.

-

Provide contextual nudges (“this month’s expenses are 15% above your baseline”).

What changes in 2026 is not the existence of these tools, but their pervasiveness.

Financial guidance stops being a premium service and becomes an ambient feature across:

-

Banking apps

-

Investment platforms

-

Wallets

-

Payroll and benefits dashboards

The key shift is normalization: people will expect smart, personalized guidance as a default, not a luxury.

4.2. Fraud Detection: The Non-Trendy, High-Impact Use Case

Fraud detection rarely trends on LinkedIn. It doesn’t demo as nicely as a chatbot.

And yet, in 2026, it will be one of the most important AI applications in fintech.

As fraudsters adopt generative tools, deepfakes and synthetic identities, traditional rule-based systems fall behind. AI-native fraud engines can:

-

Spot patterns across massive transaction graphs.

-

Detect subtle anomalies in behavior.

-

Adapt faster to new attack vectors.

This is not about hype. It’s about loss prevention, trust, and survival.

Companies that underinvest in fraud detection because it is “not sexy” will regret it.

The companies that invest quietly will gain a compound advantage in risk management and regulatory relationships.

4.3. Crypto, Stablecoins and Borderless Transfers: Pressure on the Edges

Crypto in 2026 may not have a single defining event. But it is under structural pressure.

Even in conservative environments, the following forces are at work:

-

Stablecoins offer faster, cheaper, programmable alternatives to some traditional rails.

-

Borderless transfers become increasingly important for global teams, freelancers, and cross-border commerce.

-

Regulators are experimenting, tightening and clarifying in different jurisdictions.

We may not see an overnight revolution, but we’re likely to see:

-

Stablecoins becoming more normalized in B2B and remittance flows.

-

Fintechs quietly integrating multi-rail money movement, where crypto-based solutions sit alongside traditional ones.

-

UX abstractions that hide the complexity from end users: “fast global transfer” rather than “on-chain settlement”.

The key is to see crypto not as ideology, but as infrastructure with selectively superior properties.

4.4. What Fintech Leaders Should Do Now

Strategic questions:

-

Where can embedded financial advice reduce friction and anxiety for our users?

-

How exposed are we to modern fraud vectors? Are we treating this as core infrastructure?

-

Do we need to support faster, cheaper cross-border flows in the next 12–24 months?

Practical moves:

-

Design AI advisory features with clarity and explainability, not just cleverness.

-

Audit your fraud stack with a forward-looking perspective, not last year’s risk model.

-

Explore multi-rail architectures that can incorporate stablecoins or alternative rails where they create real utility.

5. The Invisible Work: Your Next Competitive Edge

In boardrooms and conferences, AI is still mostly discussed through the lens of features: “What can we build with it?”

But the companies that will truly benefit in 2026 are the ones that ask a different question:

“Are we structurally ready for AI?”

That readiness lives in the “unsexy” layers:

-

Data discipline: clean schemas, consistent naming, ownership and lineage.

-

Process clarity: mapped workflows, defined responsibilities, sensible exceptions.

-

Interoperability: systems that can actually talk to each other and share context.

-

Trust and governance: logging, auditability, permissions, compliance.

AI doesn’t magically correct fragmentation.

It amplifies it.

When organizations plug AI into chaotic systems, they get faster chaos.

When they plug AI into coherent systems, they get leverage.

5.1. Why This Matters More in 2026

As agents start performing actions autonomously and products make decisions, the cost of errors rises:

-

A misclassified product in a catalog could lead to mispricing across thousands of transactions.

-

A broken process could cause agents to loop, escalate, or fail silently.

-

A missing governance rule could lead to regulatory exposure.

The organizations that win will look almost boring from the outside:

clear labels, well-documented systems, repeatable processes.

Inside, that “boring” clarity will be the launchpad for aggressive experimentation.

5.2. What Leaders Should Do Now

-

Elevate “systems, data and process clarity” from IT concerns to executive priorities.

-

Incentivize teams not only for delivering new capabilities, but for reducing complexity.

-

Treat governance as an enabler of innovation, not a blocker.

6. Product in 2026: From Features to Systems

Digital products are shifting from “tools users operate” to systems that collaborate with users and agents.

6.1. Products That Take Initiative

Users no longer want dashboards full of options. They want products that:

-

Notice patterns.

-

Suggest next steps.

-

Automate the obvious.

-

Escalate only when human judgment is needed.

In 2026, good products will:

-

Monitor their own health and performance.

-

Surface anomalies before they become incidents.

-

Reconfigure flows based on context (user role, region, device, risk level).

-

Act as co-pilots, not just toolkits.

Autonomy, however, is only valuable when it is aligned and explainable.

A product that acts unpredictably —even if it’s “smart”— will lose trust fast.

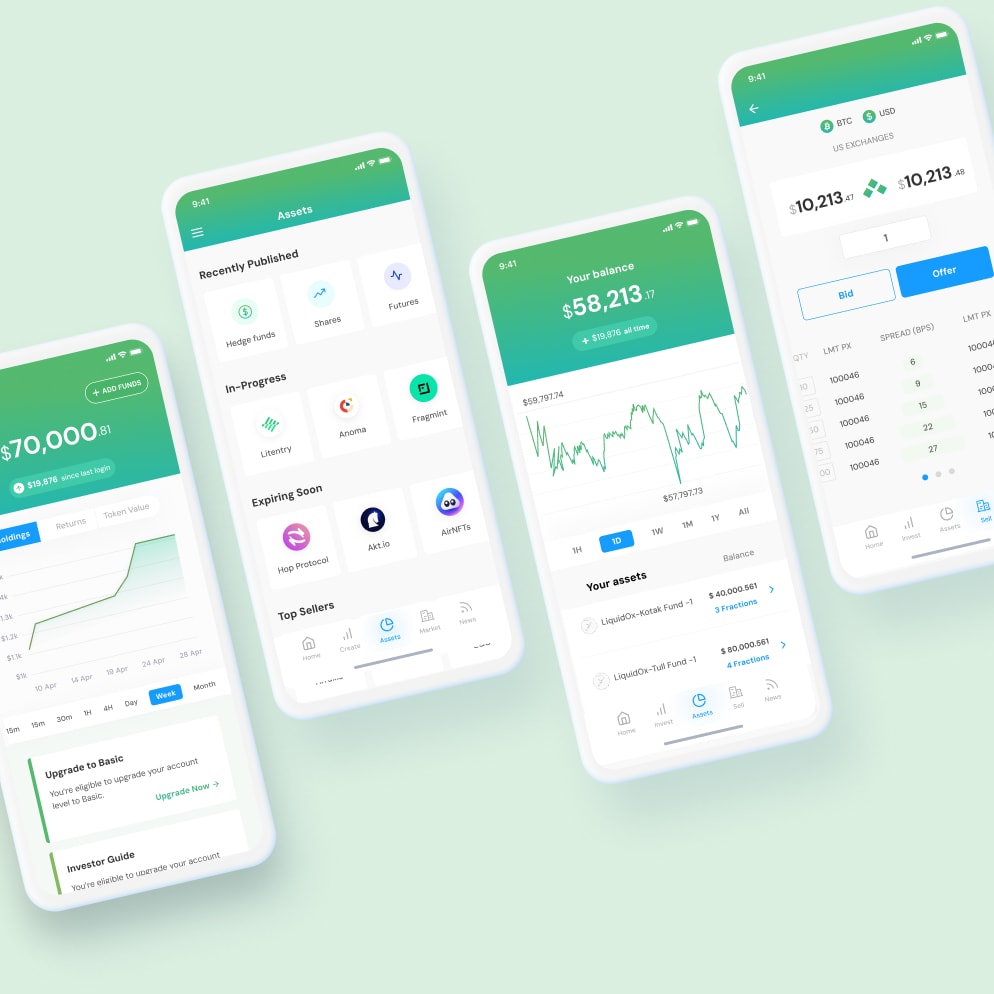

6.2. Designing for Two Audiences: Humans and Agents

Historically, product teams designed for one audience: humans.

Now they must design for two:

-

Humans who need clarity, speed and meaningful outcomes.

-

Agents that need structure, predictable behaviors and machine-readable interfaces.

This leads to dual-interface product design:

-

The human interface: visual, conversational, interaction-focused.

-

The machine interface: APIs, webhooks, structured actions, clear contracts.

A well-designed product in 2026:

-

Is intuitive for people.

-

Is exhaustively explicit for agents.

6.3. Orchestrated Ecosystems, Not Feature Lists

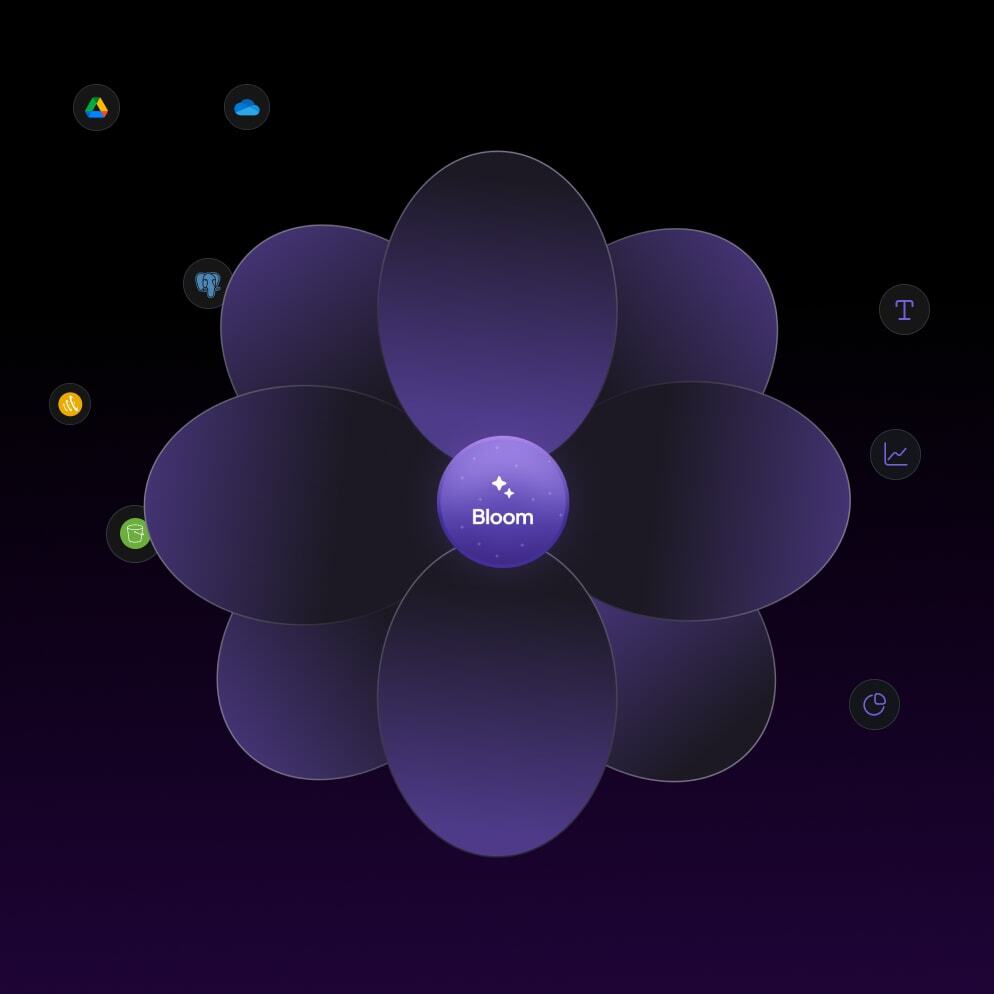

Value will increasingly come from orchestration rather than individual features.

A company might have:

-

A customer data platform.

-

A billing system.

-

A ticketing system.

-

A notification service.

-

A fraud engine.

Alone, these are just tools. Orchestrated correctly, they become:

-

A proactive upsell engine.

-

A smart risk-management layer.

-

A responsive support experience.

-

A real-time revenue intelligence system.

Product management becomes less about “owning a feature set” and more about owning flows across systems.

6.4. Product Teams as Hybrid Intelligence Teams

To operate in this new environment, product teams must evolve.

The strongest teams will combine:

-

Classic product strategy: understanding users, markets and outcomes.

-

Systems thinking: seeing products as part of larger ecosystems.

-

Data and AI literacy: knowing what is feasible and how to measure it.

-

Operational awareness: understanding how things actually run in production.

These hybrid intelligence teams don’t just ask “What should we build?”

They ask:

-

“What should this system understand?”

-

“What should it decide automatically?”

-

“Where should humans step in?”

-

“How do we keep it safe and aligned over time?”

6.5. What Product Leaders Should Do Now

-

Redefine product success metrics around systems outcomes, not just feature usage.

-

Train teams in AI fundamentals, systems design and data thinking.

-

Map key journeys end-to-end and identify opportunities for autonomy, orchestration and agent collaboration.

7. Action Checklist for 2026

To make this whitepaper actionable, here is a condensed checklist you can use in planning sessions.

Commerce

-

Audit your product catalog for machine legibility.

-

Define an agent strategy: how will assistants discover and transact with your brand?

-

Review your creative roadmap: where are you vulnerable to AI-generated sameness?

Fintech

-

Identify where AI advisory could reduce friction or improve decisions for users.

-

Evaluate your fraud detection stack in light of emerging vectors.

-

Explore whether multi-rail money movement (including stablecoins) can create real advantage.

Systems & Data

-

Map your core data entities and who owns them.

-

Reduce duplication and ambiguous naming in key systems.

-

Implement or refine governance for access, changes and auditability.

Product

-

Identify 2–3 flows where your product could take initiative rather than wait for input.

-

Define your product’s machine interface (APIs, events, schemas) as intentionally as the UI.

-

Invest in turning your product team into a hybrid intelligence team.

8. Closing

2026 will not be remembered as the year AI replaced everything.

It will be remembered as the year companies learned that:

AI is only as powerful as the systems, data and decisions it sits on top of.

The organizations that win will look different on the inside:

-

Clearer.

-

More connected.

-

More disciplined.

-

More intentional.

They will treat the “invisible work” as their sharpest competitive edge, design products that collaborate with both humans and agents, and use AI to amplify clarity, not chaos.

At Revolt, this is where we work:

at the intersection of strategy, design and technology, helping teams build systems that are ready for the next decade — not just the next demo.

Revolt

Strategy • Design • Tech